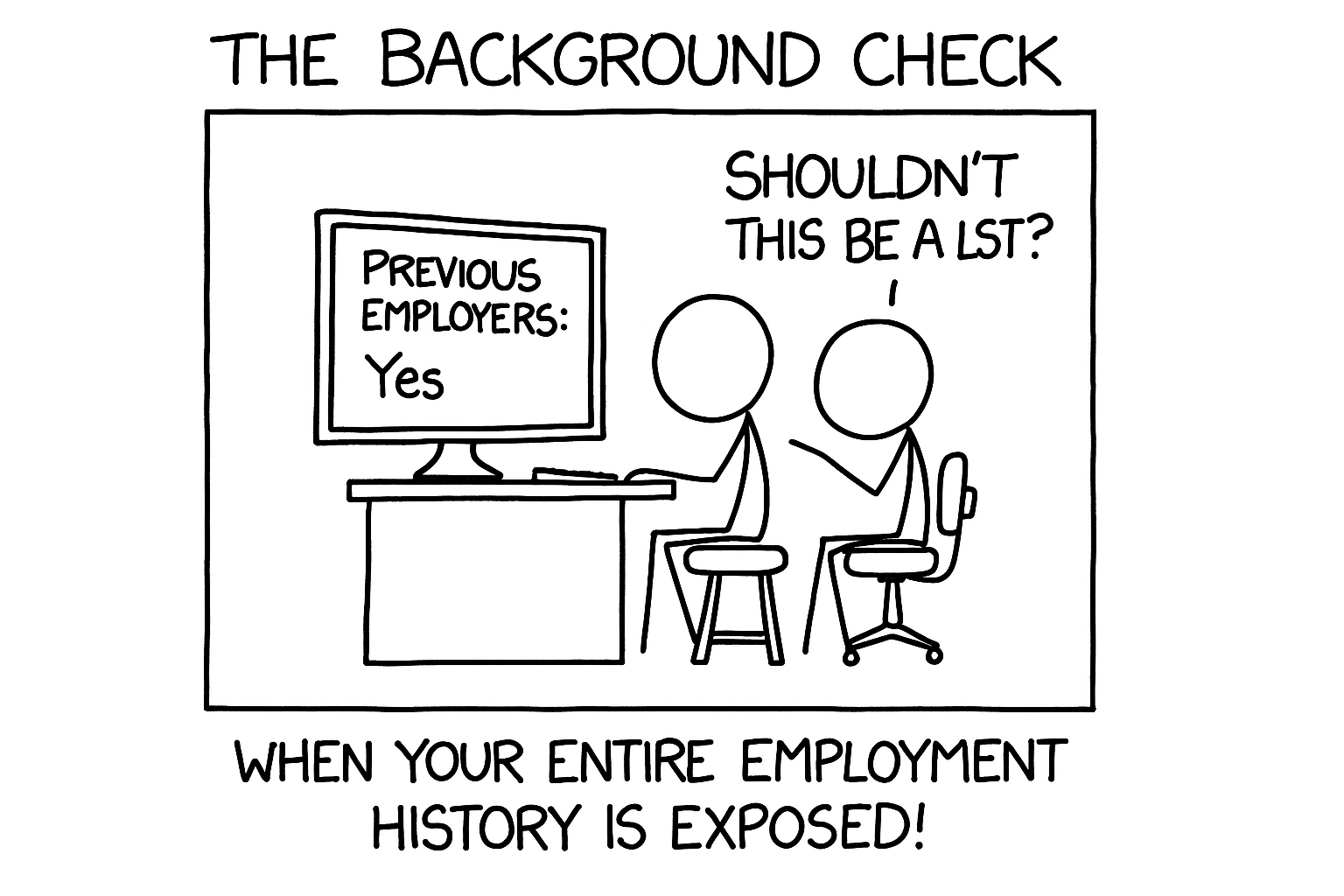

It’s an exciting moment—you’ve landed a new job. But then comes the background check form, a request for your most private information: your Social Security number, date of birth, past addresses, and a decade of employment history. It’s a necessary step to prove you’re trustworthy, right?

But have you ever stopped to consider what happens to all that sensitive data once you hit “submit”? The truth is, the very process designed to create security often exposes you to significant risk.

The current background check process, while a vital tool for employers, contains inherent loopholes—particularly the human element—that expose critical personal data to risk, undermining the very security it seeks to provide. This article will shine a light on the hidden vulnerabilities in the system and offer a guide on how to protect yourself.

The Scope of the Problem: Beyond Your Control

When you hand over your personal data, it doesn’t just go to your future employer. Your information is likely being passed to a third-party background screening company. This creates a complex chain of custody where your data is handled by multiple parties, not just the one you’re applying to.

The information itself is a goldmine for cybercriminals. It’s a complete profile of your identity:

*Your Social Security number or any other national identity number, which is a key to your financial identity.

*Your full name and date of birth.

*Your past addresses and phone numbers.

*Your employment and financial history.

*Even your criminal record, if applicable.

If a security vulnerability exists at any point in this chain — from the company that collects your information to the vendor they hire and even that vendor’s sub-contractors — your data could be at risk. And all too often, the weakest link in this chain isn’t a faulty computer system; it’s a person.

The Loopholes: The Human Element as the Weakest Link

The most significant threat to your data isn’t a hacker trying to brute-force a password. It’s the people with authorized access to your information.

The Insider Threat

Employees at background check companies have direct access to a treasure trove of personal data. While most are trustworthy, a single unscrupulous or careless employee could easily misuse this information. This can lead to:

Data Theft: An employee could download a list of records and sell it on the dark web for a profit.

Identity Fraud: A bad actor could use your information to open credit cards, take out loans, or file fraudulent tax returns in your name.

Carelessness and Lack of Training

Even with the best intentions, employees can make mistakes. Inadequate security training can lead to poor data handling practices. Imagine an employee leaving a laptop with an unencrypted spreadsheet of personal data at a coffee shop or a phishing email tricking an employee into revealing their login credentials. A single error can expose thousands of records.

Inadequate Vetting of the Vetting Companies

Perhaps the greatest irony is that the employers who are so careful to vet you often don’t properly vet the companies they hire to do the background checks. Many companies don’t perform rigorous security audits on their vendors, leaving them vulnerable to data breaches. The assumption is that these “background check companies” must be secure, but this is a dangerous gamble.

Mitigating the Risks: A Path Forward

Given these risks, what can you, as an employee or job seeker, do to protect yourself? And how can employers and the industry itself build a more secure system?

For the Employer

Employers have a responsibility to protect the data they collect.

They should:

*Conduct rigorous due diligence on any background check vendor, asking detailed questions about their security protocols.

*Insist on data encryption and secure handling throughout the entire process.

*Choose vendors with strong security certifications, such as ISO 27001, which demonstrates a commitment to information security.

For the Individual (Applicant)

You are not powerless. When asked for your data, you have the right to:

*Ask direct questions about how your data is secured, how long it will be stored, and who will have access to it.

*Request a copy of your own background check report to ensure all information is accurate and that no fraudulent data has been added.

*Use credit monitoring services for several months after a background check to quickly detect any new accounts or inquiries.

For the Industry

Ultimately, the background check industry needs to change.

This requires:

*Stricter regulations and enforcement to hold companies accountable for data breaches.

*Implementing multi-factor authentication and biometrics for employees with access to sensitive information, making it much harder for an insider threat to act alone.

*A commitment to transparency with clients and applicants about security measures and data handling.

Conclusion: A Call for Transparency and Accountability

The background check process is not a perfect, impenetrable shield. It is a system built on trust that, paradoxically, contains a significant risk to personal data. The human element, with all its potential for carelessness or malice, is the weakest link.

True security is a shared responsibility. Employers, background check companies, and individuals must all work together to prioritize privacy and security in an increasingly data-driven world. By raising awareness and demanding better practices, we can transform the background check from a potential digital minefield into a truly secure process.